The year 2020 will have completely changed the cards in the office real estate sector. Faced with the Covid-19 crisis, which is never-ending, and the difficulties companies are experiencing in meeting their rents, charges, and contractual obligations, they have no choice but to opt for more flexible and agile solutions. At the same time, the use of remote work and the revival of coworking spaces are questioning the benefits of keeping a "showcase" head office and are calling for more and more outsourcing of work. 2020 will thus have made it possible to become aware of this need for agility and to build a new, healthier and more egalitarian scheme between lessors and users. It is indeed more than legitimate to question the relevance of the current model and the future of the commercial lease or 3/6/9 lease that still governs the real estate market. A change of leases is therefore necessary for most companies.

Can the 3/6/9 lease disappear?

It seems obvious that in the face of the prevailing uncertainty, companies are more wary of the idea of having recourse to a classic lease and of committing themselves on a long term basis.Let's remember that the termination of a classic lease can generally be done only after a period of three years. Hence its name(3/6/9 lease). This "rigidity" is mainly due to market practices and is an echo of the balance of power between lessees and lessors.

Thus, while there have been numerous accompanying measures, recording their highest rate since 2017 (20.9%), lease renegotiations are customary and aim to reduce the real estate costs of companies (3.9%).The aim is to reduce real estate costs, the third largest expense item after human resources and IT, and to move towards more suitable work organizations.

According to the latest figures released by Immostat, it would appear that the office real estate market will have recorded a decline of 1.321 million square meters of leased office space by 2020, a drop of nearly 45%. These figures are confirmed by another study which reveals that 60% of companies plan to renegotiate their lease and rent in 2021 and that 36% want to reduce their surface area.

In addition, beyond the simple context linked to Covid-19 and this unprecedented crisis, several other economic factors come into play the rigidity of the 3/6/9 lease such as the development of new technologies, the shortening of economic cycles or the internationalization of the economy. Faced with so many new and uncertain imperatives, companies are demanding more flexibility.

The awareness is such that users wish to benefit from a new model capable of reflecting the real quality of a real estate asset. The real use of the m² or the energy performance of the buildings are looked at in more detail. It is no longer a question of seeing empty open spaces and underutilized m².

Similarly, the continuation of telecommuting and the increased use of coworking spaces are also contributing to the volatility of the real estate market. In a study dated September 2020, Barclay's, even estimates between -10 to -20% of the demand for square meters by 2030 in Europe.

While waiting for the consolidation of the models, the large groups wish today to subcontract to third party operators the management of their spaces and their personnel, and tend to turn more towards the coworking centers which play the outsourcing card.

Discover the coworking spaces for rent in Paris

Who benefits from these lease changes?

The desire of companies to find new premises or offices for rent is however very real. This demand can be explained by the need to control costs by reducing rental charges, as well as by the need to reorganize, following the reduction of on-site personnel and the development of telecommuting. The 3/6/9 lease is therefore not destined to disappear completely, but it will certainly no longer represent 100% of the market. It will have to coexist with flexible space offers. The demand for smaller and more flexible workspaces should be reinforced in 2021.

However, if companies aim to slow down investments and long commitments, then the massive use of coworking centers and other flexible workspaces should be confirmed. There is plenty of room for improvement, since according to an analysis by Colliers International, they only represent 2% of the office market in France!

Discover the coworking spaces for rent in Lille

Nevertheless, these spaces will have to show once again their flexibility and adapt to the demands of their occupants: secure, agile and unlimited work spaces, technological, and billed in proportion to their use.

The latter thus appear to be the appropriate response to all users' expectations. Their growth and use are evidence of a strong trend.

"It was in September that everything really picked up, with demand up 25% compared to the pre-Covid-19 period. This is a sure sign that the movement has inexorably started", analyzed Christophe Burckart, General Manager of the French department of IWG (International Workplace Group) in the columns of France 3.

While new models and players will certainly emerge in the months and years to come, the real estate sector will once again have to adapt to meet these new constraints, starting with offering a legal framework adapted to commercial leases and coworking service contracts.

-

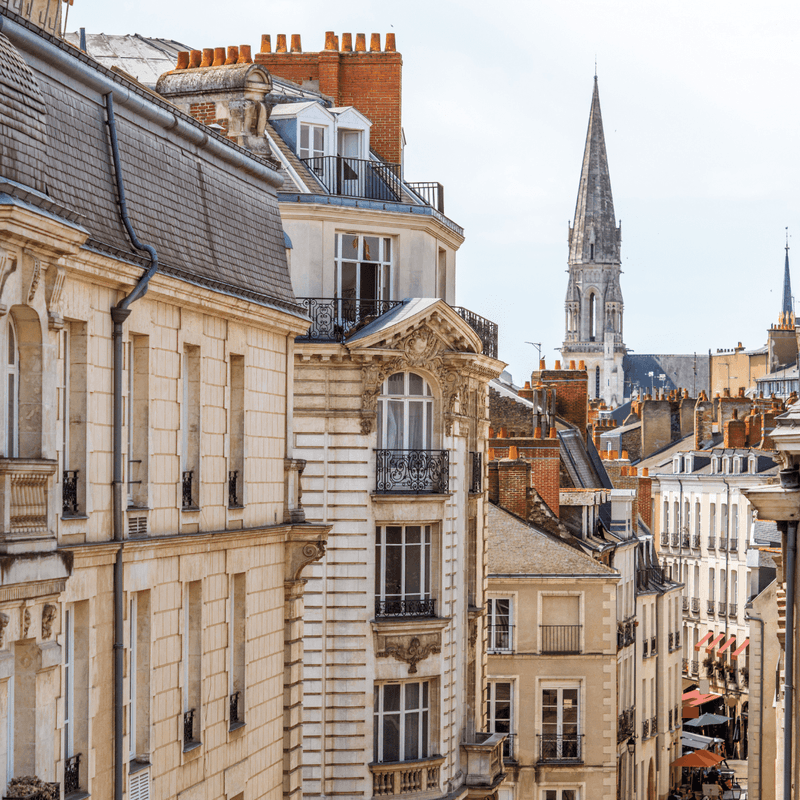

Top 5 coworking spaces in Nantes

07/01/2026 Top 5 coworking spaces in Nantes

In Nantes, the office real estate market is experiencing a trompe-l'œil recovery: with 42,100 m² placed in the first half of 2025 (+14% vs. 2024), momentum seems to be picking up, but the market remains structurally fragile.New supply is scarce, average floor space is shrinking (386 m²), and the rise of telecommuting is causing office occupancy rates to fall below 50% on certain days. However, coworking, and more specifically the flexible office in Nantes, is emerging as a concrete response to new working practices for major accounts and their employees.

-

Sport coworking: when the workspace becomes a place of well-being and performance

22/12/2025 Sport coworking: when the workspace becomes a place of well-being and performance

After the democratization of telecommuting, the rise of the flex-office and the growing popularity of third places, a new trend is quietly but surely emerging: sports coworking. A trend as powerful as the French craze for running in France. At the crossroads of well-being, performance and transformed uses, these hybrid spaces are challenging the way we live and work.

-

Announcing the birth of new coworking spaces

01/12/2025 Announcing the birth of new coworking spaces

Looks like the family is growing! Everywhere in France in 2025, new coworking spaces and flexible workspaces are springing up, in Paris of course, but also in Rennes, Dijon, Clermont, Brest, and even in small towns that had never seen a shared office before.