A few months ago, we could have agreed that if the coworking spaces seduced more and more the large groups, in fact, they were used by only few of them. The latter only saw in these flexible spaces an opportunity to help creativity and innovation of certain project teams. It is now under a new light and with new ambitions that large companies are studying the relevance of the model, even going so far as to transform their vacant spaces into coworking spaces. Beyond flexibility, the subject of outsourcing skills is at the heart of the debate. Synonymous with well-being, cost control and agility, coworking spaces are constantly being renewed!

How is the coworking market evolving?

Although the coworking market has been affected by the coronavirus crisis, like all other sectors, it is still buoyant.

After weighing nearly 30 billion dollars in 2018, the global coworking market could reach 120 billion in 2025 according to Welkin & Meraki. A slightly more measured observation in the latest Xerfi study, "Post-crisis opportunities in the coworking and flexible office market - Growth levers and prospects by 2023", which states that the coworking and flexible office market will grow by aboutThe study states that the sector should become more structured in the coming year, with a focus on operated offices - or corpoworking - and hospitality management. This change in direction will require a new positioning for these spaces, which will oscillate between operators of their own spaces and service providers. The market is gradually taking shape and is based on a model borrowed from the hotel industry. The operators of coworking spaces and hybrid spaces are announced as the main players in this market of operated offices. Among the most active on the territory, we note the Anglo-Saxon WeWork and Regus followed by Wojo, Morning and Spaces.

Discover all the coworking spaces available in Paris

Philippe Morel, President and Co-Founder of Dynamic Workplace, recently spoke to La Tribune about the role of these new generation operators: "The role of the office space operator is twofold: Firstly, as an upstream advisor on the design of uses, digital equipment and services, alongside the company and its employees, as well as the investor. And secondly, as a player, a single point of reference within the building, integrator of all services, guarantor of the effective quality of services, marketing and, globally, of the economic model. Using the codes of the hotel and retail industries, this new type of operator also ensures the animation of the residents' community. A property that is operated is thus an asset that often consumes less square footage, is more serviced and more animated, and whose commerciality is strengthened, thus sustainably better valued.

Beyond this reinforcement of the offer addressed to the large users, the market of the coworking is indeed revealed to be a heavy tendency because it answers more than ever the needs for diversification and adaptation of the companies. It is also a solution to the reluctance of companies to enter into traditional leases.

A CBRE study shows that 86% of CEOs of large companies worldwide are looking for a "mixed office solution".

Who are the users of coworking spaces?

We have understood that coworking is no longer only for freelancers and entrepreneurs. The profiles of users have expanded to the point of seducing large groups who wish above all to rethink their real estate in a global approach including a certain financial aspect, but also social.

For example,Engie has outsourced its digital department in the Saint-Lazare train station area in Paris, bringing together nearly 120 employees who did not want to work in La Défense. It is also quite natural that the Carrefour Group has set up shop in the WeWork Paris 13 space since 2019, as well as Thales, which has deployed its "Digital factory" within the WeWork Lafayette space. Morning has just announced the opening of a coworking space in the headquarters of Nestlé, in Issy les Moulineaux.

Beyond the financial and flexibility aspects mentioned above, these users also increasingly use coworking spaces for operations such as moving, to ensure continuity of activity in case of unavailability of sites (notably due to the limited rate of presence on site at the moment) or simply to avoid searching for new sites, often costly and time-consuming.

These are just some of the reasons why flexible office space will continue to be attractive to large groups, and why it will have a place of choice in the office real estate market, which has been shaken up by the health crisis.

-

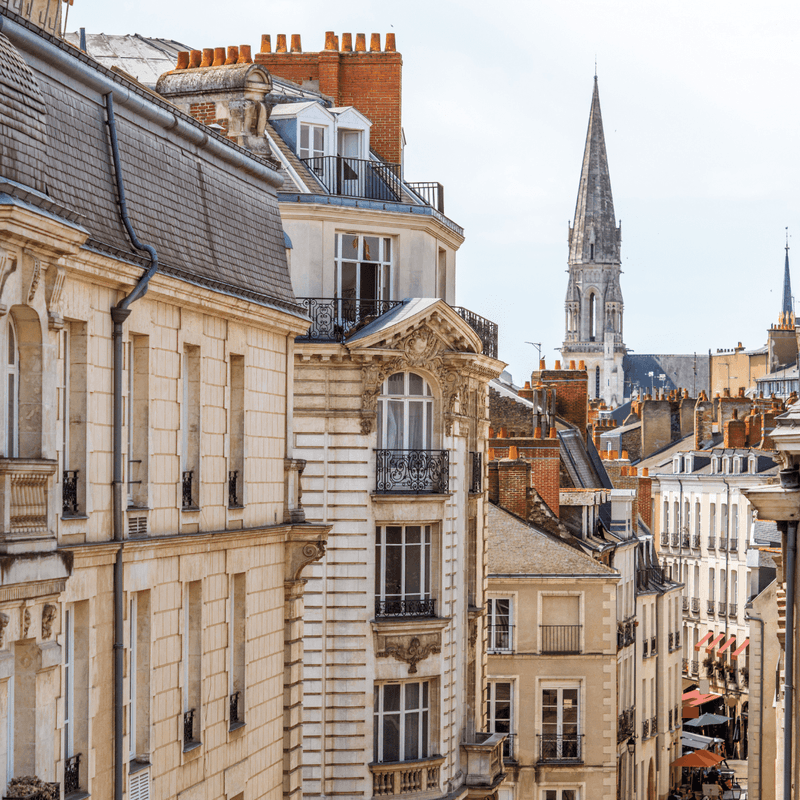

Top 5 coworking spaces in Nantes

07/01/2026 Top 5 coworking spaces in Nantes

In Nantes, the office real estate market is experiencing a trompe-l'œil recovery: with 42,100 m² placed in the first half of 2025 (+14% vs. 2024), momentum seems to be picking up, but the market remains structurally fragile.New supply is scarce, average floor space is shrinking (386 m²), and the rise of telecommuting is causing office occupancy rates to fall below 50% on certain days. However, coworking, and more specifically the flexible office in Nantes, is emerging as a concrete response to new working practices for major accounts and their employees.

-

Sport coworking: when the workspace becomes a place of well-being and performance

22/12/2025 Sport coworking: when the workspace becomes a place of well-being and performance

After the democratization of telecommuting, the rise of the flex-office and the growing popularity of third places, a new trend is quietly but surely emerging: sports coworking. A trend as powerful as the French craze for running in France. At the crossroads of well-being, performance and transformed uses, these hybrid spaces are challenging the way we live and work.

-

Announcing the birth of new coworking spaces

01/12/2025 Announcing the birth of new coworking spaces

Looks like the family is growing! Everywhere in France in 2025, new coworking spaces and flexible workspaces are springing up, in Paris of course, but also in Rennes, Dijon, Clermont, Brest, and even in small towns that had never seen a shared office before.