The coworking and flexible office sector has entered a new phase in its development. After a decade marked by dazzling expansion,_ in just two years, the four French coworking players have increased their surface area by 43%, to 302,000 m² under management,_ the market is undergoing a more measured, but equally strategic transformation. According to a recent study by Xerfi, this evolution is characterized by more reasoned growth, geographic diversification and a repositioning towards the needs of major accounts. By 2026, coworking will no longer be just an innovative model, but an essential component of new ways of working.

Coworking and flexible working spaces: a healthy market

The coworking and workspace market looks set for a bright future in the capital and the major regional metropolises. According to Le Parisien, the main operators are unanimous: "demand is increasing".

The boom in the market between 2019 and 2022 has doubled the amount of space available in France. However, this boom has revealed its limits. The economic crisis, combined with rising financing costs and sometimes unsustainable growth models, has called into question the expansion strategies of coworking players. The market is now stabilizing at around 6% annual growth through to 2026, with promising prospects of exceeding 1.3 million square meters. This more moderate growth reflects a new maturity, focused on optimizing resources and adapting to the specific needs of companies.

A notable change, however, lies in the geography of the market: long concentrated in Paris and the Île-de-France region, coworking is now spreading to major regional me Lyon, Bordeaux and Marseille , but also to medium-sized cities such as Metz, Bayonne and Clermont-Ferrand, and even to smaller towns.

This geographic redistribution is a response to the saturation of the Parisian market and the growing attractiveness of these regions. Regional locations also ease the pressure on employees by reducing commuting distances, while promoting a more balanced location of economic activities. This move towards regional spaces is being driven by players such as Flex-O, Newton Offices and Bureaux & Co, who are adapting their offer to meet local specificities while maintaining high standards.

Coworking takes on major accounts

We may be stating the obvious, but this is one of the strategic pivots of the market. While coworking has historically targeted freelancers and startups, large corporations now represent a major growth lever. These organizations are looking for flexible solutions to adapt to changing work environments, particularly with the spread of telecommuting. Flexible offices offer considerable advantages, from reducing long-term financial commitments to improving the employee experience. They also make it possible to respond to social responsibility imperatives, thanks to spaces designed to minimize environmental impact.

The end of hyper-growth and the adoption of reasoned growth

To adapt to these new realities, players in the coworking and flexible office market are redoubling the innovation of their business models. Some are opting for partnerships with investors to share risk and secure financing. Others are adopting franchising approaches or management contracts with building owners, reducing initial investments while involving the latter in the performance of the spaces. Market consolidation is also gathering pace, as smaller players struggle to survive in the face of the dominance of big names such as IWG (Regus, Spaces), Wojo and Morning. This concentration is enabling the leaders to acquire strategic locations and diversify their offer.

However, this transformation is not limited to a reorganization of the players. By 2026, coworking will have to meet some major challenges if it is to become a permanent fixture on the landscape. Flexibility, already at the heart of its DNA, will be an essential prerequisite. Companies will continue to look for adaptable spaces, capable of evolving according to their needs. At the same time, operators will need to enrich the user experience with innovative services, such as collaborative events, wellness services or advanced technologies to optimize connectivity and productivity. Finally, environmental impact will become a key differentiating factor, requiring workspaces to be eco-responsible and incorporate the principles of the circular economy.

The coworking and flexible office market in 2026 will therefore be very different from the one we know today. More structured, more integrated, it represents an essential response to the new aspirations of companies and employees alike. This mutation, far from being a simple evolution, marks the emergence of a hybrid model that redefines the traditional codes of work and office real estate. Coworking, once seen as an alternative, is now establishing itself as an essential pillar of modern working environments.

Ø Read the full study on the Xerfi website

-

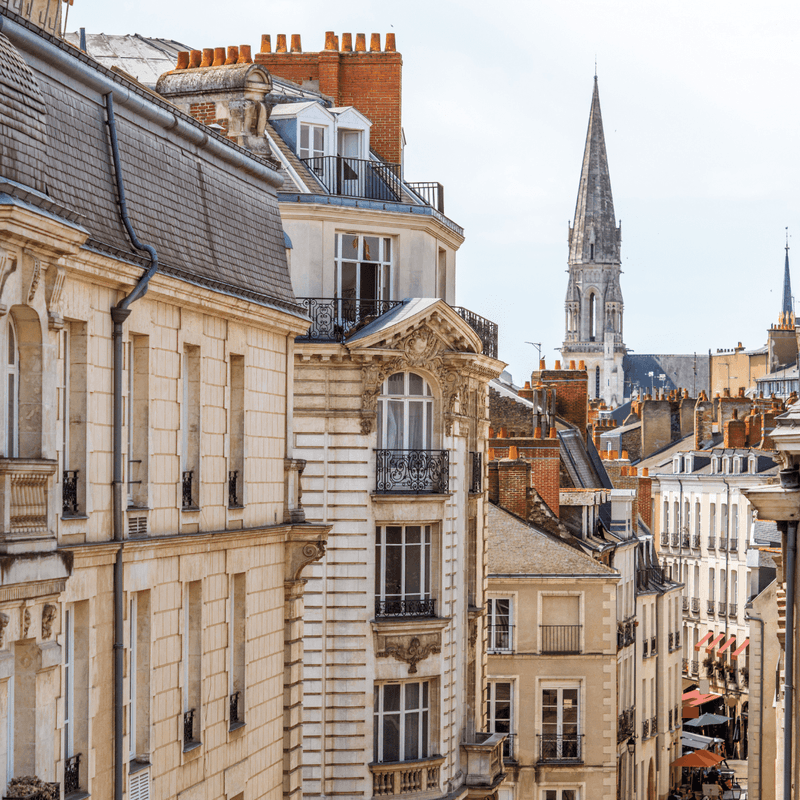

Top 5 coworking spaces in Nantes

07/01/2026 Top 5 coworking spaces in Nantes

In Nantes, the office real estate market is experiencing a trompe-l'œil recovery: with 42,100 m² placed in the first half of 2025 (+14% vs. 2024), momentum seems to be picking up, but the market remains structurally fragile.New supply is scarce, average floor space is shrinking (386 m²), and the rise of telecommuting is causing office occupancy rates to fall below 50% on certain days. However, coworking, and more specifically the flexible office in Nantes, is emerging as a concrete response to new working practices for major accounts and their employees.

-

Sport coworking: when the workspace becomes a place of well-being and performance

22/12/2025 Sport coworking: when the workspace becomes a place of well-being and performance

After the democratization of telecommuting, the rise of the flex-office and the growing popularity of third places, a new trend is quietly but surely emerging: sports coworking. A trend as powerful as the French craze for running in France. At the crossroads of well-being, performance and transformed uses, these hybrid spaces are challenging the way we live and work.

-

Announcing the birth of new coworking spaces

01/12/2025 Announcing the birth of new coworking spaces

Looks like the family is growing! Everywhere in France in 2025, new coworking spaces and flexible workspaces are springing up, in Paris of course, but also in Rennes, Dijon, Clermont, Brest, and even in small towns that had never seen a shared office before.