2024 marks a black year for the office market, and this is all the more true for the Ile-de-France region, since according to the latest figures from the Immostat barometer, the vacancy rate reached the unprecedented level of 10.3%. The Ile-de-France market ended the year with 1,750,400 m² of office space newly leased or sold to an occupier: a total down 11% year-on-year, and 21% below the average for the last ten years. The context is certainly varied, but the facts are there. On the other hand, the implementation of flexible office organizations provides sufficient room for maneuver, enabling the sharing of flexible workspaces. What if 2025 really is the year of flex? Welcome to the era of shared offices and integrated coworking.

A shrinking office stock

With vacancy rates on the rise in major cities, office space owners are looking for ways to make the most of their unoccupied square meters. But what if the answer came from those who, every day, are looking for a place to work without isolating themselves?

The structural transformation of the workplace has left its mark on commercial real estate. According to Immostat data, at the end of the year, the Paris region had 5.64 million m² of immédiately available, corresponding to an average vacancy rate in excess of 10%, and even exceeding 20% in some areas. These figures confirm a structural shift in the world of work towards more flexible forms of working, such as the flexible office, which combines physical presence, telecommuting, job-sharing and the reduction of real estate space by companies.

However, the causes are manifold, and the development of telecommuting does not explain everything. Immostat also points out that 2024 was marked by a climate of economic and geopolitical uncertainty, prompting many organizations to slow down their projects and investments, including in real estate.

The office is no longer a given, it has become a strategic choice.

But these choices leave gaps that real estate players had not anticipated on this scale. The flexible office therefore appears more as a complementary model than a simple stop-gap measure.

Faced with this market context, it no longer appears as a niche phenomenon, but is establishing itself as a structural component of the hybrid city. A CSA study for Malakoff Humanis revealed that 84% of employees would like to continue teleworking in the future.

But demand is not just coming from freelancers. It also comes from :

- telecommuting employees who can no longer work at home full-time,

- VSEs and start-ups looking for real estate flexibility,

- large corporations testing "hub & spoke" models, combining smaller headquarters and local satellites.

The idea of transforming vacant offices into open, flexible spaces is appealing to local authorities and asset managers alike, who see it as a way of :

- reduce rental vacancies

- generate alternative income without a firm lease

- revitalize neighborhoods that are losing their commercial appeal.

Finally, it should be noted that such high vacancy rates will certainly lead to the accelerated exclusion of ageing assets from the market, in the face of abundant new competition aligned with corporate CSR objectives and offering attractive financial terms.

Conditions for success

Transforming vacant offices into shared office space is not an easy task.

Spaces need to be adapted:

- flexible, mobile partitioning and furniture,

- secure access, high-speed connectivity,

- flexible but structured governance (charter of good use, reception, services).

We also need to clarify the legal framework: service provision contract, overriding lease, cross-liability insurance.

Above all, we need to create a living ecosystem. A flexible workspace without a community or a lively atmosphere is just a meaningless open space.

Vacant square meters are a challenge, but also a tremendous opportunity to rethink our relationship with workspace. Rather than leaving them empty, why not share them? Coworkers aren't the saviors of commercial real estate - they're the forerunners of a more flexible, more humane and more sustainable future.

-

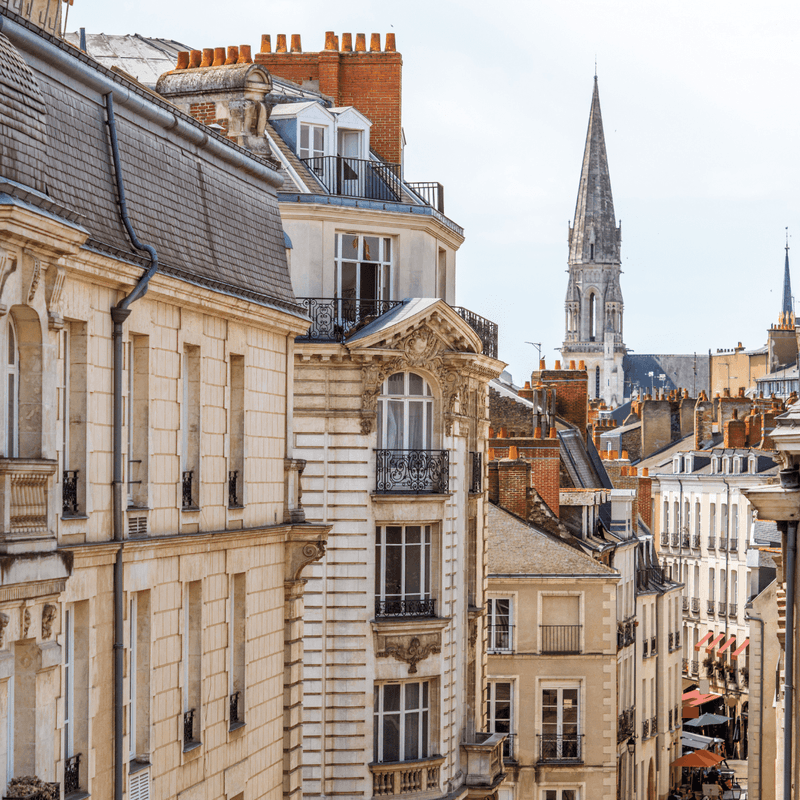

Top 5 coworking spaces in Nantes

07/01/2026 Top 5 coworking spaces in Nantes

In Nantes, the office real estate market is experiencing a trompe-l'œil recovery: with 42,100 m² placed in the first half of 2025 (+14% vs. 2024), momentum seems to be picking up, but the market remains structurally fragile.New supply is scarce, average floor space is shrinking (386 m²), and the rise of telecommuting is causing office occupancy rates to fall below 50% on certain days. However, coworking, and more specifically the flexible office in Nantes, is emerging as a concrete response to new working practices for major accounts and their employees.

-

Sport coworking: when the workspace becomes a place of well-being and performance

22/12/2025 Sport coworking: when the workspace becomes a place of well-being and performance

After the democratization of telecommuting, the rise of the flex-office and the growing popularity of third places, a new trend is quietly but surely emerging: sports coworking. A trend as powerful as the French craze for running in France. At the crossroads of well-being, performance and transformed uses, these hybrid spaces are challenging the way we live and work.

-

Announcing the birth of new coworking spaces

01/12/2025 Announcing the birth of new coworking spaces

Looks like the family is growing! Everywhere in France in 2025, new coworking spaces and flexible workspaces are springing up, in Paris of course, but also in Rennes, Dijon, Clermont, Brest, and even in small towns that had never seen a shared office before.